Our Investment in Pluang: The Investing Super App for Southeast Asia

Today we’re thrilled to announce Accel has led an investment into Pluang, the leading investing super app for Southeast Asia. Pluang is Accel’s fourth investment in a next-gen investing app in a distinct region across the globe, joining Public in the U.S., Trade Republic in Europe, and Flink in Latin America. Pluang is also joining the Accel family of companies in Southeast Asia, which includes Xendit, Axie Infinity, Nansen, and Astro.

Starting with Indonesia (the fourth largest country by population and fifth largest GDP in Asia), Pluang is making it easy for individuals to access investment products that enable them to build wealth for themselves and their families. While some may take this for granted in developed investing markets like the U.S. and in Europe, in emerging markets like Southeast Asia and Latin America, there are millions of consumers who have never before had access to investment products such as local or international equities, mutual funds, ETFs, and crypto.

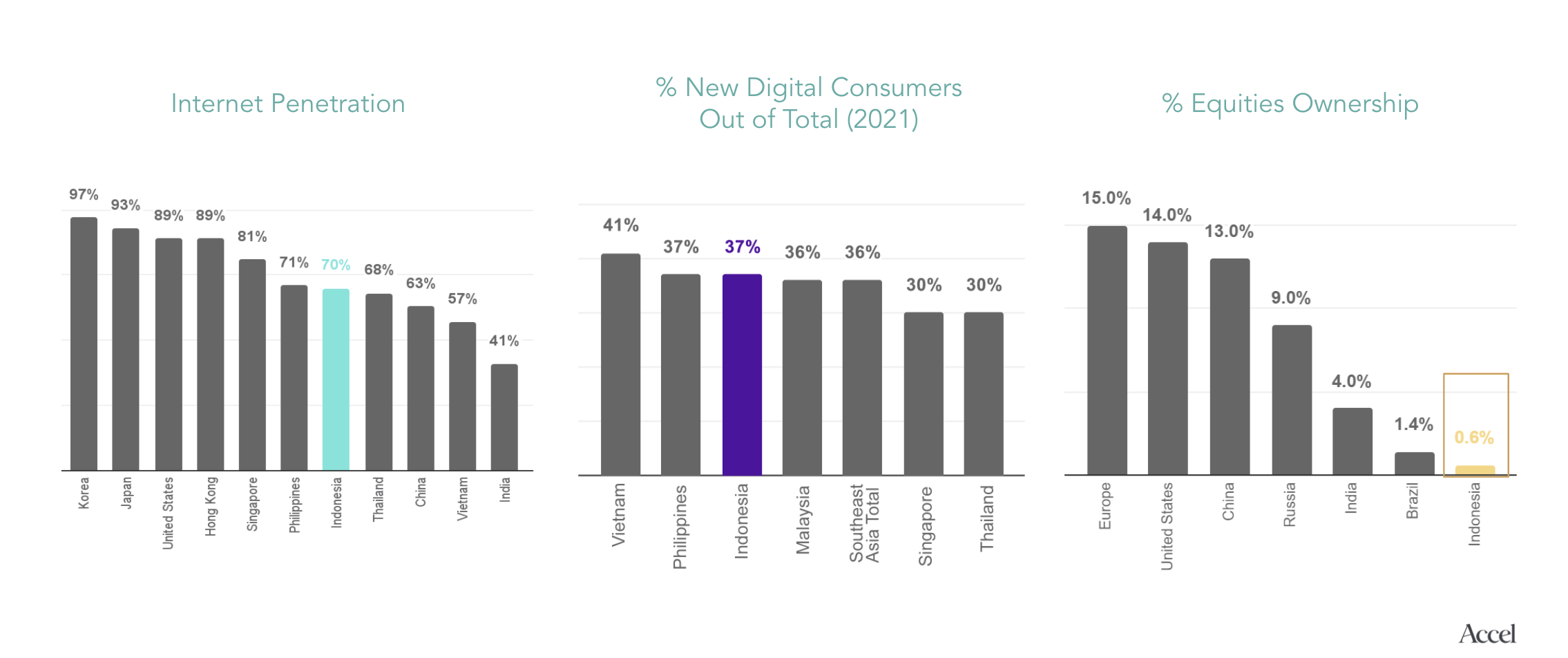

The opportunity is enormous, with the vast majority of over 270 million Indonesians and 655 million Southeast Asians coming online financially for the first time over the last few years and the number of retail investors in Indonesia alone having almost tripled over the last three years. Despite this, Indonesia’s equity ownership is still less than 1%, compared to 14-15% in Europe and the U.S. and so we anticipate tremendous growth over the next decade. Southeast Asia is a fast growing tech hub and we expect the region to experience the fintech and funding explosion that Latam experienced in 2021, buoyed by the tailwinds of a large population of unbanked consumers coming online, a rapidly growing middle class, increasingly high internet and smartphone penetration, and world-leading adoption of cryptocurrencies.

Having seen investing products developed globally, we’ve come to appreciate the local nuances that make these products transformational in their respective regions. In Pluang’s case, this is most embodied by the way Pluang’s founders, Claudia Kolonas and Richard Chua, have thought about their entry investment asset class - gold.

In Indonesia, there are over 80 million gold holders - 16x that of any other asset class and it’s the investing asset class that the local population trusts most. As such, Pluang was built with gold serving as the wedge to help users learn how to invest in multiple asset classes over time. Claudia and Richard partnered with other popular apps in the region, including GoJek, Tokopedia, Bukulapak, and Dana, to embed gold investing in those experiences and leverage the distribution and reach of these partners. As a result, Pluang has on-ramped millions of users cost effectively and with very little capital expended. Along the way, they’ve responsibly used educational content to turn gold investors into savvy, multi-asset investors.

Being multi-asset class is critical to build a category-leading business in the region. Given the local Indonesian equities market is still early in its development in comparison to the U.S. or Europe, with only 125 companies with market caps of over $500M, trading volumes (while growing quickly) are a fraction of that in the U.S. and even other developing economies like India. Pluang is uniquely positioned in this golden moment, as the only player to have gone through the multi-year process to acquire the licenses and build the products to offer gold, fractional Indonesian equities, global equities and indexes, crypto, and mutual funds.

Most importantly, our excitement to invest in Pluang stems from our admiration of Claudia and Richard and their commitment to not just to build a category-defining business, but to make a lasting economic impact on all of broader Southeast Asia. Anyone who has spent time with this special duo has come away energized and inspired, and we’re grateful for them letting us join their journey.

We’re thrilled to be joined by Trung Nguyen, Andy Ho, Aleksander Leonard Larsen, and Jeffrey Zirlin (Axie Infinity founders), Alexa von Tobel (former Learnvest CEO), Daniela Binatti (Pismo CTO), Sujata Bhatia (Monzo COO), Jannick Malling and Leif Abraham (Public.com co-CEOs), Raghu Yarlagadda (FalconX CEO), Sergio Jimenez (Flink CEO), The Chainsmokers, BRI Ventures, Goldhouse, as well as previous investors Square Peg, Go-Ventures, UOB Venture Management, and Openspace Ventures.

Together we look forward to helping Pluang build towards their vision of empowering the hundreds of million first-time investors in Southeast Asia to build wealth for themselves and their families.

12 Jan

2022

%20(1).png)