Looking ahead at fintech’s future and unveiling our Fintech 100 EMEA

Last week, we brought together thought leaders from our portfolio and beyond to discuss the future of fintech at Landing Forty Two in London. You can view our full presentation here.

It’s hard to deny that 2022 was a tough year for technology, with the fintech market hit particularly hard. A challenging climate saw tech multiples return to long term averages, with leading fintech multiples down ~50-75%.

Despite a strong first half of the year, private fundraising also finished down significantly and the IPO and M&A market remained largely closed. That said, we see a bright future ahead for the fintech industry. Fintech is still young as a category and the opportunity is huge.

Fintech’s bright future

Fintech is an increasingly dominant part of the technology ecosystem. Over the last decade, more than $200B has flowed into fintech across North America, Europe and Israel - the first venture-fuelled fintech innovation cycle for the financial services industry. This cycle has seen fintech grow its share of overall technology funding to $22 of every $100 invested, up from just $4 in 2013 and $13 in 2017 - an inexorable rise.

.avif)

What’s driving this increase? Fintech products are everywhere. Every generation of fintech has gone broader and deeper, touching more areas of our daily lives.

Rewind a decade and the first few fintech apps – mostly wallets and money transfer products – were appearing on our phones. Today, fintech touches every area of our personal and professional financial lives: neobanks, remittance, BNPL, taxes, investing, expense management, crypto, credit cards, salary advances, P2P transfers, insurance and the list goes on. What’s more, the convergence of fintech and software is proving to be the catalyst for a whole new wave of disruption.

The Fintech market is a $10T opportunity

Financial services represents a ~$10T global market cap opportunity, one of the largest – if not the largest – industry in the world.

Today, the industry is dominated by global, regional and national incumbents who have spent years, decades and centuries building and reinforcing barriers to entry. Going after these players is not for the faint-hearted, but what’s so special about financial services is that the fintech market has already been defined – every new entrant is able to take aim at an existing revenue and profit pool. Players of all sizes are jumping in, from fintech unicorns to public disruptors to Big Tech.

.avif)

But the fintech ecosystem is still very early on its journey. A huge amount of value has been created in fintech over the past decade, with more than 300 public and private $1B+ fintechs globally (ex. China) worth almost $1.4T. That said, only ~40 of these companies (~$425B market cap) have crossed the bridge to public markets. This is a big number, but represents less than 5% of the broader financial services industry.

Most leading fintechs – including the household names we know today – were only born in the last decade. Financial services is a regulated industry full of powerful incumbents and it takes time to create disruptive, durable and category-defining businesses. We expect the next decade to see many exciting fintechs mature and cross into the hands of public shareholders.

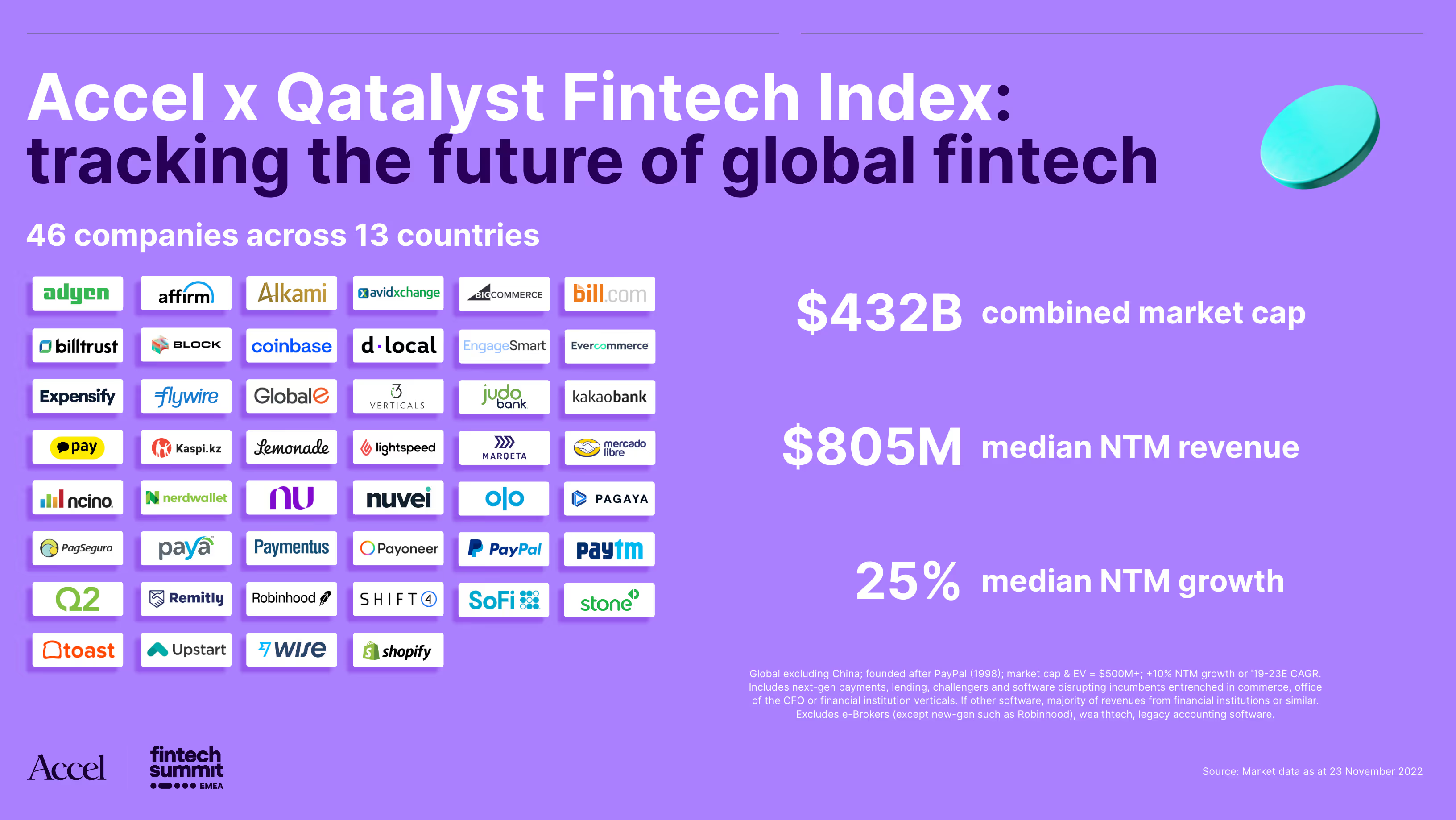

Accel x Qatalyst Fintech Index: tracking the future of global fintech

The industry is early and public markets are in disarray.

That said, we feel we’re nearing an inflection point that requires a way to track fintech’s global evolution in public markets. Together with Qatalyst, we’re pleased to launch the Accel x Qatalyst Fintech Index. This global index covers 46 world-class fintechs across 13 countries with a combined market cap of over $430B.

We’ll share more soon - watch out for the ticker!

The promise of Europe

Fintech is global, but a look at the story of European fintech reveals why we’re excited and why we think you should be too.

Rewind a few centuries and the story of financial services began in Europe. It’s home to many of the world’s oldest institutions, from the oldest surviving bank in Siena to the first stock exchange in Antwerp and the oldest existing insurer in London.

Europe feels like a very natural home for fintech: it’s large, wealthy and digital. What’s more, it has unique qualitative factors: things that do work like the rule of law and forward-leaning regulators, but also things that don’t work like a fragmented banking system and national boundaries that force founders to think globally from day one. Europe has every right to be a world-class fintech hub.

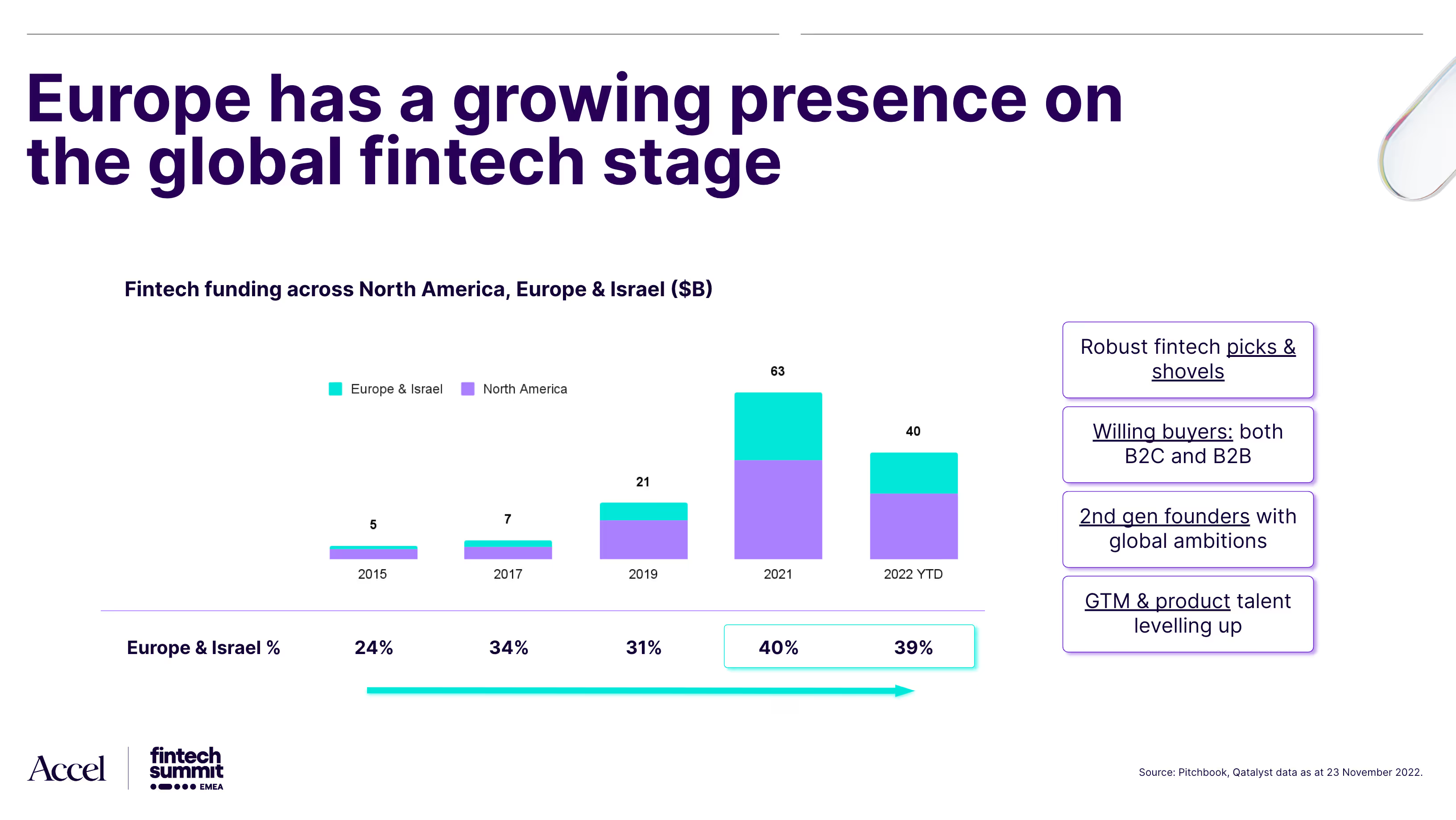

On the global fintech stage, Europe is a rising power. Looking back six years, fintech funding was all about North America. Fast forward to today, and Europe accounts for $4 in every $10 of funding flowing into Western markets. More than ever before, it has robust fintech picks and shovels, willing buyers and sophisticated founders and talent.

Europe’s top fintech breakouts have each raised over a billion dollars in funding over the last three years across a range of categories. Europe is increasingly home to world-class fintechs that look strikingly similar to their US counterparts.

Europe’s rising wave of fintech founders

A leading indicator for any ecosystem’s maturity is second generation founders who have been on the journey with first generation fintech breakouts. We analysed 61 fintech unicorns founded in Europe and Israel and found that since the 2008/9 financial crisis, former employees of those unicorns have gone on to found more than 300 companies, of which 40% are new fintech startups. The talent flywheel is spinning and Europe’s founders today are experienced, battle-tested and ambitious.

London is the beating heart of fintech, home to four of the world’s ten most valuable private fintechs and tied with the Bay Area in terms of fintech funding over the past two years (at ~$17B apiece). Beyond London, Europe’s ecosystem is broader and deeper than any other region. We counted more than 70 $1B+ fintechs across 21 cities in Europe and Israel, with world-class hubs emerging across Tel Aviv, Berlin, Paris and more.

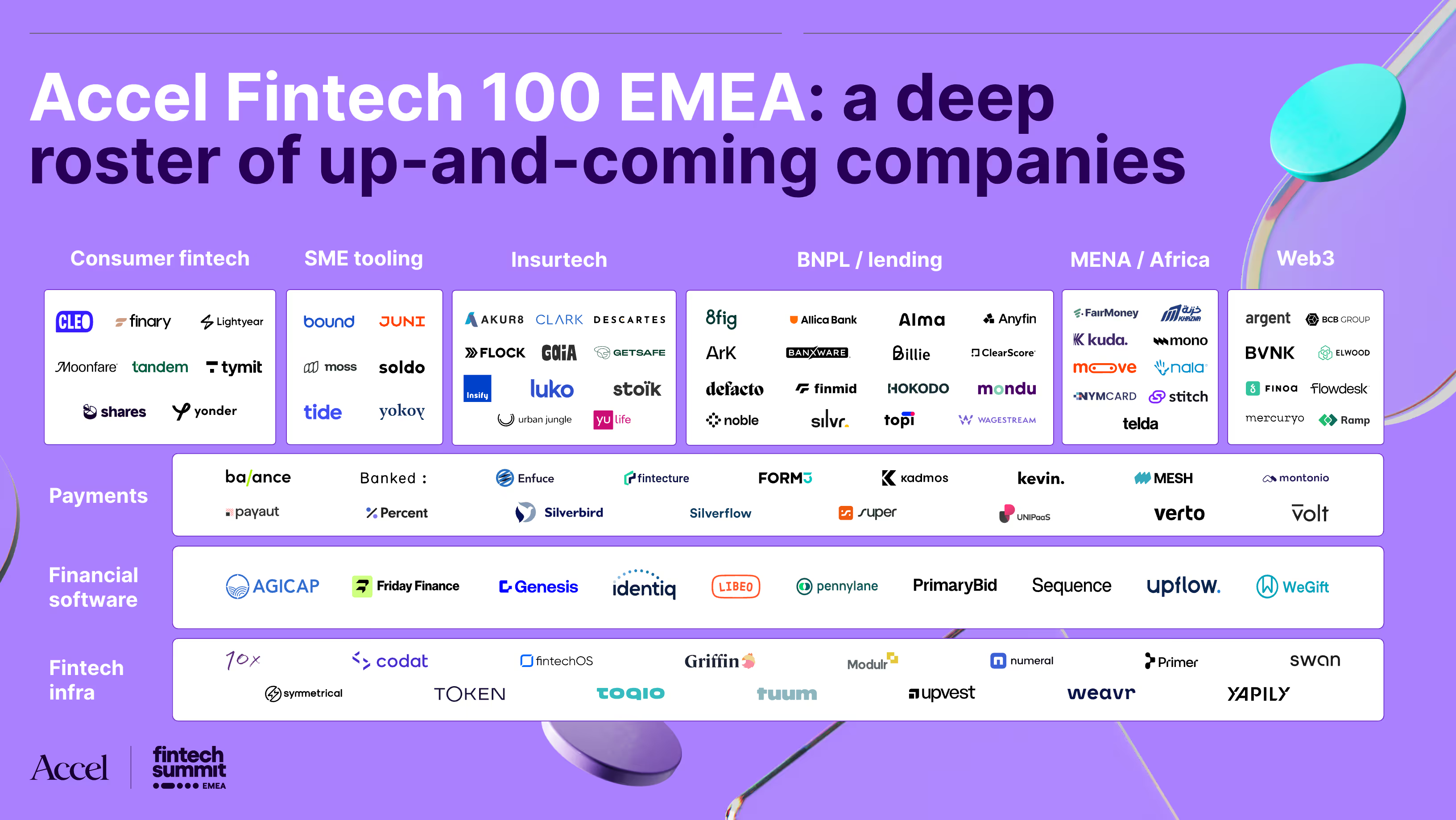

Accel’s inaugural Fintech 100 EMEA

As early stage investors in fintech, we’re always on the lookout for the talented founders and teams who will transform financial services and we’re excited to unveil our first Fintech 100 list.

Of the 5,000+ fintechs across 40+ countries in the region, we’ve selected a shortlist of 100 companies (founded since 2015, $10M+ funding, valued at less than $1B). Based on momentum, market, product and team, we believe many of these will be among the next generation of category leaders.

A few interesting statistics about this list: these companies are based in 21 cities across 16 countries and employ more than 17,000 people. They’ve raised almost $8B in funding and have >75% median FTE growth over the last 12 months. We’re pleased to congratulate the teams on this list for their tireless efforts in building these exciting companies.

And what does the future hold for fintech? Take a look at some themes we’re excited about in the final section of the full presentation here.

Great companies aren't built alone.

Subscribe for tools, learnings, and updates from the Accel community.