The future of European fintech and Accel’s Fintech Summit 2022

.avif)

The fintech landscape is gathering momentum at an unprecedented pace. Today, there are more than 180 $1B+ fintechs globally, growing 8x compared to 2016, and the most valuable private companies in the US, Europe and Latam are all fintechs (Stripe, Klarna, Nubank<sup>1<sup>). Not only is fintech seeing record-breaking funding and valuations, the sector’s value creation is happening at record pace: the 2021 crop took less than four years on average to reach unicorn status and this number is decreasing every year.

Europe’s fintech golden age

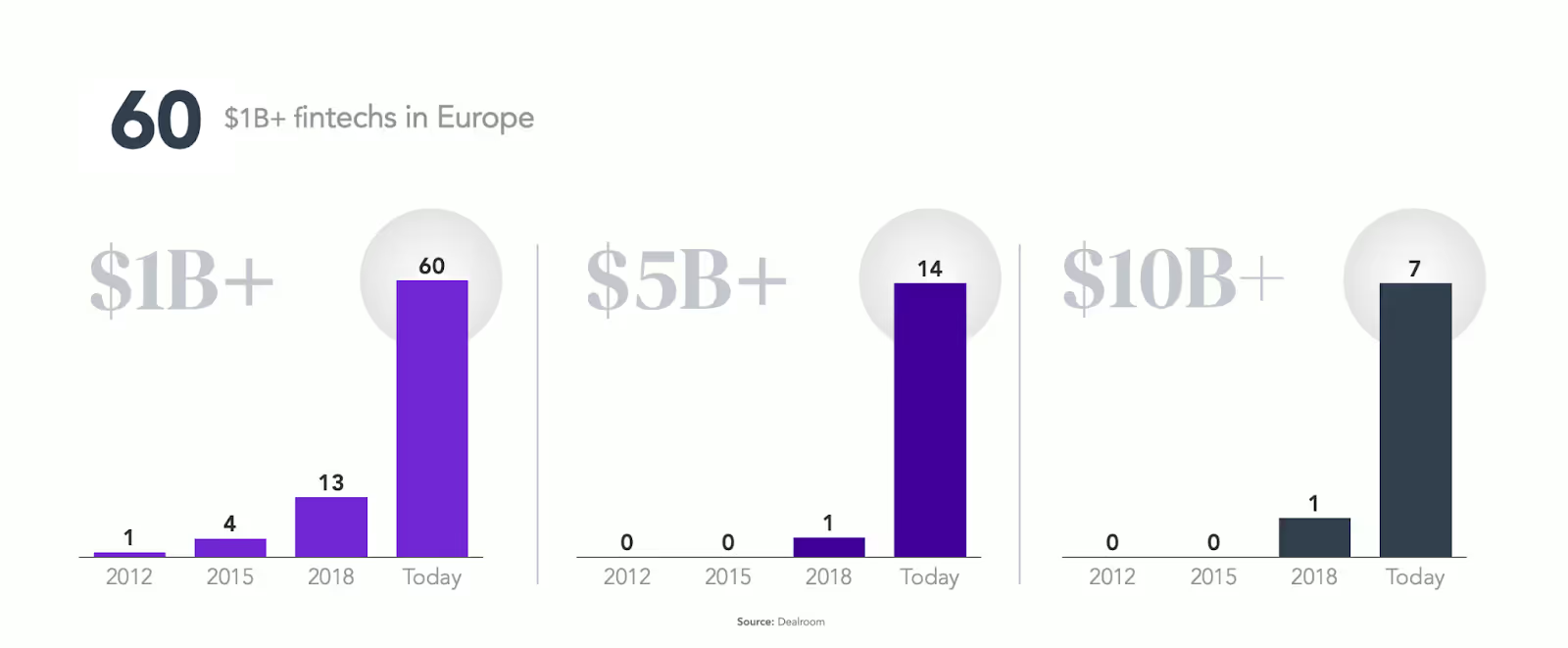

Europe is at the forefront of this fintech revolution. The region smashed the record for annual investment in its fintechs just halfway through 2021, with $12.8B invested (nearly 1.5x more than all of 2020). As the year comes to a close, the large funding rounds continue with Monzo, Mambu and Pleo, all announcing raises within days of each other. Today, there are 60 $1B+ fintechs in Europe and seven of these are $10B+. It’s a very different picture to just three years ago.

Yet, we believe European fintech is just getting started. Europe has a deep history as the center of financial innovation: the modern banking system was born in Italy, the first stock exchange in Belgium and the first insurance company in the UK. With a progressive regulatory landscape and flourishing ecosystem of technical and product talent, the stage is set for Europe to build the next generation of global fintech leaders.

The fintech journey so far

Let’s look at how the fintech ecosystem became what it is today.

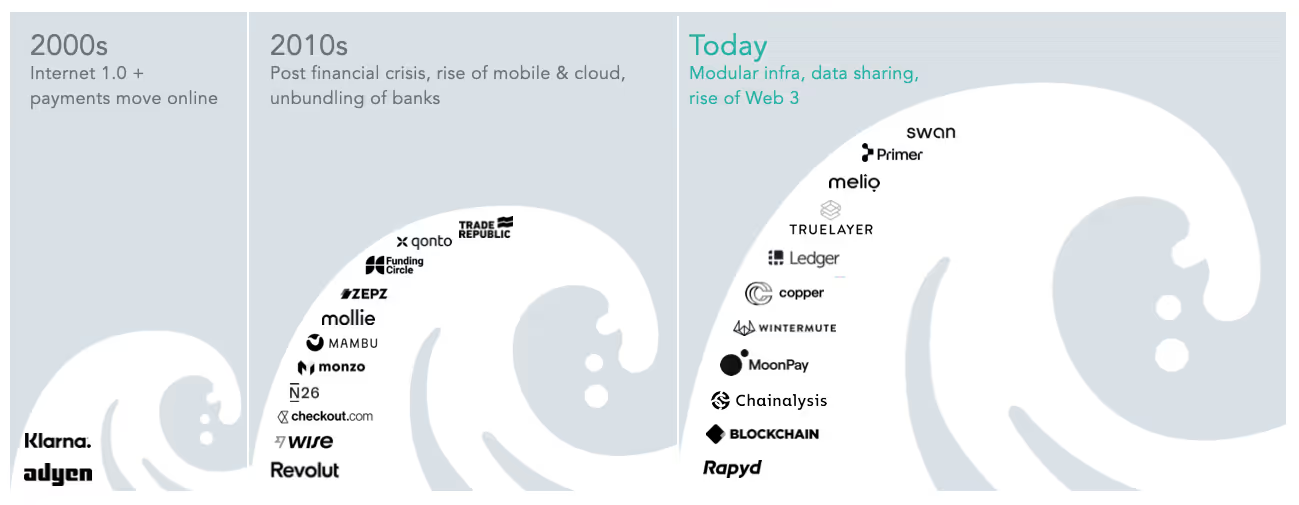

There are diverging views as to when fintech really kicked off, but most agree that the advent of ecommerce in the early 2000s ushered in a wave of online payment services, exemplified by PayPal, the OG fintech company.

Fast forward to the 2010s, when a new fintech wave emerged post the financial crisis. The collapse of household names like Lehman Brothers and growing distrust in financial institutions prompted a shift away from traditional banking and an urgency to forge a new path. Alongside shifting consumer behaviour, smartphones and the cloud enabled new fintechs to rapidly innovate and unbundle the banks, piece-by-piece. On the back-end, the infrastructure layer was being rebuilt, with monolithic tech stacks being replaced by plug and play tooling. Companies like Solarisbank and Mambu led the way in providing out-of-the-box infrastructure and freeing up engineering talent to focus on innovation. On the front-end, new fintechs revolutionised the customer experience and reinvented centuries-old services, including P2P transfers, remittances, lending and more. A generation of exciting consumer fintechs like Klarna, Revolut, Monzo and WorldRemit (now Zepz) were born.

Today, we’re seeing a new generation of fintechs emerging. These companies are able to launch and scale faster than ever before, standing on the shoulders of previous generations. Both fintechs and non-fintechs can leverage modular tech stacks and regulatory-driven data sharing (with the advent of PSD2 in Europe), allowing them to launch new products rapidly and effectively. Companies can issue cards with Marqeta, embed financial products with Swan, and offer trading services with Drivewealth. This means they can spend their time and energy not on infrastructure, but on nailing use cases, launching new products and getting to market in record time. Web3 is also creating a programmable and transparent foundation upon which new business models and use cases can be built. The chance to rebuild the financial apps we know and love on Web3 rails could be a once-in-a-lifetime opportunity.

Our first Accel Fintech Summit

What does 2022 and beyond have in store for the fintech landscape? We feel fintech has only just scratched the surface and over the coming months, we’ll be publishing a series of posts (similar to our insurtech Prepared Mind) that examine what we believe are some of the most exciting fintech areas ahead:

Next year, we’ll also be hosting our first Accel Fintech Summit. Here, we’ll be showcasing some of Europe’s most exciting fintechs, talking to some of the incredible teams we’ve partnered with over the last two decades and hoping to inspire the next generation of fintech founders to take the leap and start building. For insights ahead of our event into how Trade Republic’s Christian, Zepz’s Ismail, Chainalysis’ Michael and others built their fintech businesses, you can read their Secrets to Scaling interviews.

We’re excited about what’s ahead and hope you are too! If you or someone you know is building something that will shape the future of fintech or you’re keen to hear more about our Fintech Summit, we’d love to hear from you.

- Team Accel (reach us at FintechSummit22@accel.com)

Great companies aren't built alone.

Subscribe for tools, learnings, and updates from the Accel community.