Unveiling our consumer fintech and SME panels at our Fintech Summit EMEA

.avif)

As we countdown to our Fintech Summit EMEA on 29 November, we’re thrilled to announce the latest speaker line-up for our consumer fintech and SME panels.

When the pandemic hit and the world went into lockdowns in 2020, digital engagement accelerated. Not only were businesses forced to change the way they served customers, but consumer expectations shifted. Unable to hit high streets to access shops and local bank branches, people flocked online to shop, bank, pay, invest and more. Trends that were already underway - partly due to the demand of younger generations - gathered pace. According to the World Economic Forum’s Global COVID-19 FinTech Market Rapid Assessment Study, the fintech industry saw average growth accelerate to 13% in 2020 and the increase was higher still in countries with stricter lockdown measures. The increased popularity of neobanks, super apps, investment and saving platforms, and an overall shift to digital remained when the world opened up again.

.avif)

Similarly, SMEs turned to fintechs to help them navigate the pandemic as analog transactions and products were no longer possible. Digitisation was no longer just a way to reduce inefficiencies - the ability to manage payments remotely and digitally was necessary for survival and greater cash flow control was put in the spotlight. Whether accounting, payments and spend management platforms, or accessible small business loans, SMEs turned to fintech for support. Not only was there a spurt of innovation and adoption during the pandemic, but SMEs showed their resilience and didn’t just adapt and survive, but thrived and grew.

Now, as consumers and SMEs alike face an economic downturn, the role of fintechs in helping both navigate the rockier path ahead has come to the fore again. Now more than ever, fintechs have a critical role in providing technology that enables consumers and SMEs to better monitor, understand and control their finances.

For the fintech themselves, many great companies have been built and scaled during previous crises and the importance of continuing to innovate can’t be underestimated. If you’re building the next category leader in fintech, apply for our Fintech 100 list now and win the chance to be in the in-person audience to see the panels below.

.avif)

Keen to hear what the future holds for consumer and SME fintech? Sign-up to be part of our virtual audience now!

.avif)

Consumer fintech panel

With rising interest rates, rocketing inflation, and consumer confidence declining, consumer fintechs are focusing more than ever on how to best support their customers and increase retention. Providing ongoing value and ensuring useful interactions for customers are key. However, innovation and experimentation remain vital for long term growth and differentiation. Our panelists from Monzo, Revolut, Trade Republic and Zepz will be discussing the balance between customer retention and continued innovation, the importance of listening to customers and more.

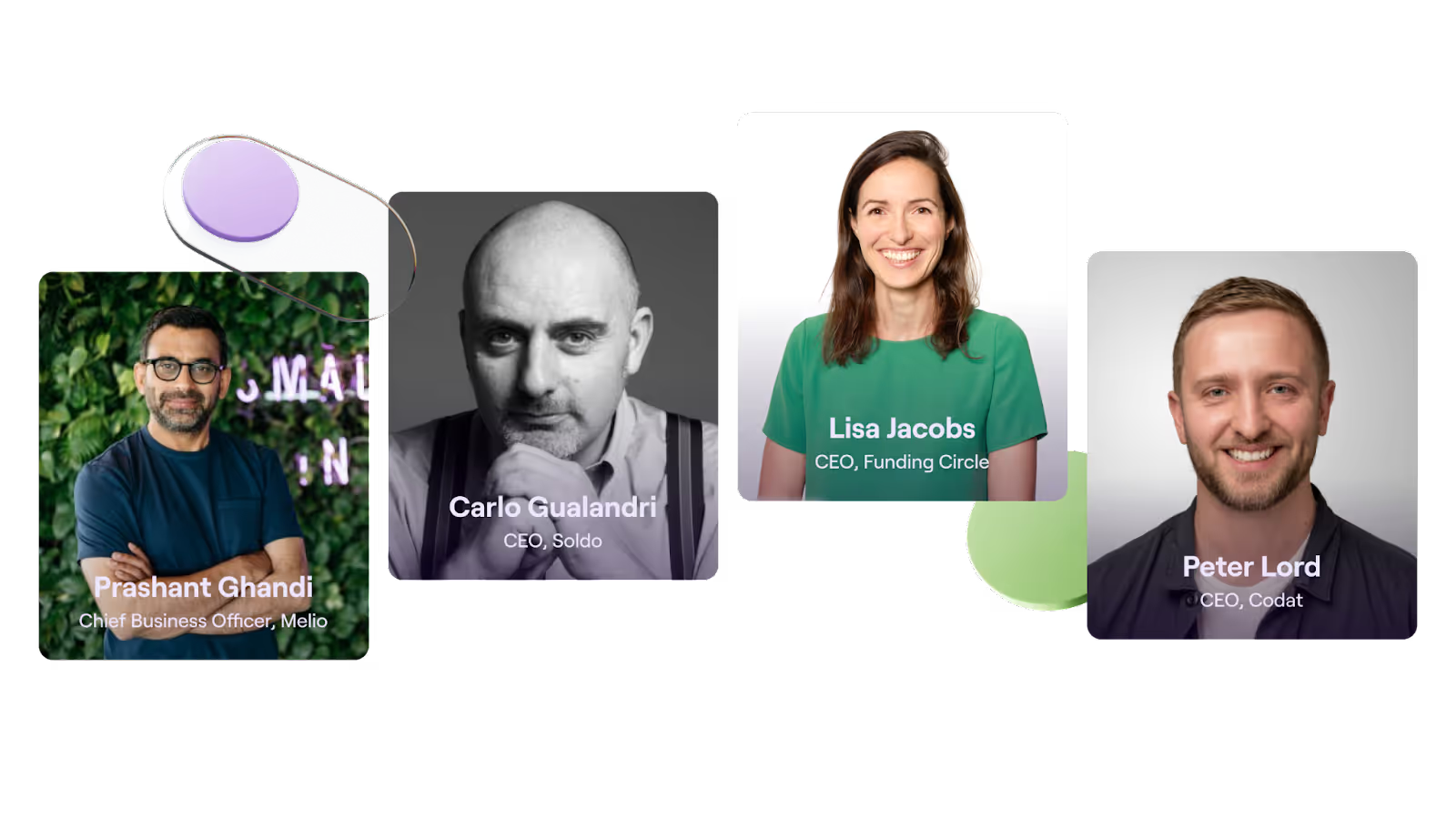

SME panel

According to Capgemini research, 89% of SMEs surveyed feel underserved by their primary bank and would consider shifting to a challenger. Particularly in times of uncertainty, SMEs can struggle to gain financing, manage cash flow and find the right tools to provide financial transparency and efficiency. Now, SME-focused fintechs solve this and are not only meeting SMEs financial needs and providing them with more clarity and efficiency, they’re enabling them to thrive. Join our virtual audience and find out what our panelists from Codat, Funding Circle, Melio and Soldo think lies ahead on 29 November.

.avif)

Great companies aren't built alone.

Subscribe for tools, learnings, and updates from the Accel community.