Prepared Mind: The fintech infrastructure landscape and four predictions for the future

A detailed look at industry dynamics in fintech infrastructure, and what the next generation holds

In our last European fintech Prepared Mind post, we took a closer look at the dynamic and fast-growing world of payments, revealing five predictions that are set to inform the next chapter in its evolution. In this edition, we explore the interconnected world of fintech infrastructure — a space with many of the same players and dynamics.

The fintech industry has unquestionably created enormous value in the global economy over the past decade. Much of this growth has been underpinned by the development of robust infrastructure which enables companies — both fintechs and non-fintechs — to:

- Offer tailored banking products (debit, credit and savings accounts) to their customers

- Unlock access to critical financial data (e.g. banking, card, accounting system, e-commerce)

- Offer trading / brokerage-type functionality

- Access local payment schemes and cross-border services

Fintech infrastructure democratizes access to financial products and enables developers and start-ups to shift their focus to building their unique end-user value proposition. However, developing this infrastructure is expensive and time-consuming. Founders who are able to successfully develop a company in this space unlock tremendous value, not just for the services or functionality that can be accessed directly, but also due to the potential for additional value-add or complementary products to be layered on top.

Looking to the future of fintech infrastructure, we feel there are a number of opportunities for significant value creation.

Time for embedded financial services products to shine

Many of the world’s leading marketplaces and platforms have been developing in-house financial products in order to bolster their proposition to customers as well as increase economic activity. With services like Shopify Capital, merchants can benefit from seamless application and approval processes for cash advances and loans.

These embedded financial products contribute to 36% higher sales as merchants invest in inventory and marketing, promoting growth. Unfortunately for most, building bespoke embedded financial services offerings is incredibly complex. It requires local compliance, credit risk, and AML expertise — a non-starter for many businesses.

As marketplaces and platforms increasingly seek to improve their unit economics, build deeper customer relationships and stay competitive, we anticipate further acceleration of embedded finance.

Lending in particular can have a meaningful impact on these platforms and their customers, not only improving economic activity, but also the cash cycles of platforms’ underlying customers and overall economic health.

With risk appetite shrinking across the financial sector, we anticipate banks and other traditional financial institutions will pull back on less profitable customer segments, such as SMEs and gig workers. This leaves space for marketplaces, platforms, and vertical SaaS companies to offer customized and bespoke financial products, leveraging a combination of their unique customer data, strong customer relationships, and — most importantly — third party embedded finance partners.

In addition, the proliferation of Open Banking platforms has democratized access to data that was historically limited to financial institutions making it easier than ever to underwrite risk. — especially as many platforms and marketplaces have direct access to their customers’ real-time revenue data and streams.

The next generation of fintech infrastructure

2021 was the year of the largest bull run in crypto history, with crypto market cap nearly tripling as it approached $3T in assets. Many of the firms enabling the explosive growth of crypto (e.g. exchanges), whilst crypto-first, are not crypto-only. They largely have the same banking and payment needs that traditional fintechs have, including access to local payment schemes and bank accounts. As such, standard fintech infrastructure will increasingly serve crypto / web3 natives with tailored solutions.

2020/2021 also saw the dramatic growth of fiat on-ramps, such as MoonPay, solve the payment acceptance problems crypto firms regularly face as they accept fiat. Many of these solutions rely on a multitude of partners to service their customers, including traditional acquirers, payment processors, and even banks.

Despite the fact that there’s a potential crypto winter, we anticipate the proliferation of more dedicated and full stack fiat offerings for crypto natives to emerge from within the fintech infrastructure world. Many of these will solve issues related to KYC/onboarding, banking-as-a-service, and payments in ways that fully address the dynamic and unique demands of this transformational technology.

The emergence of European FinOps champions

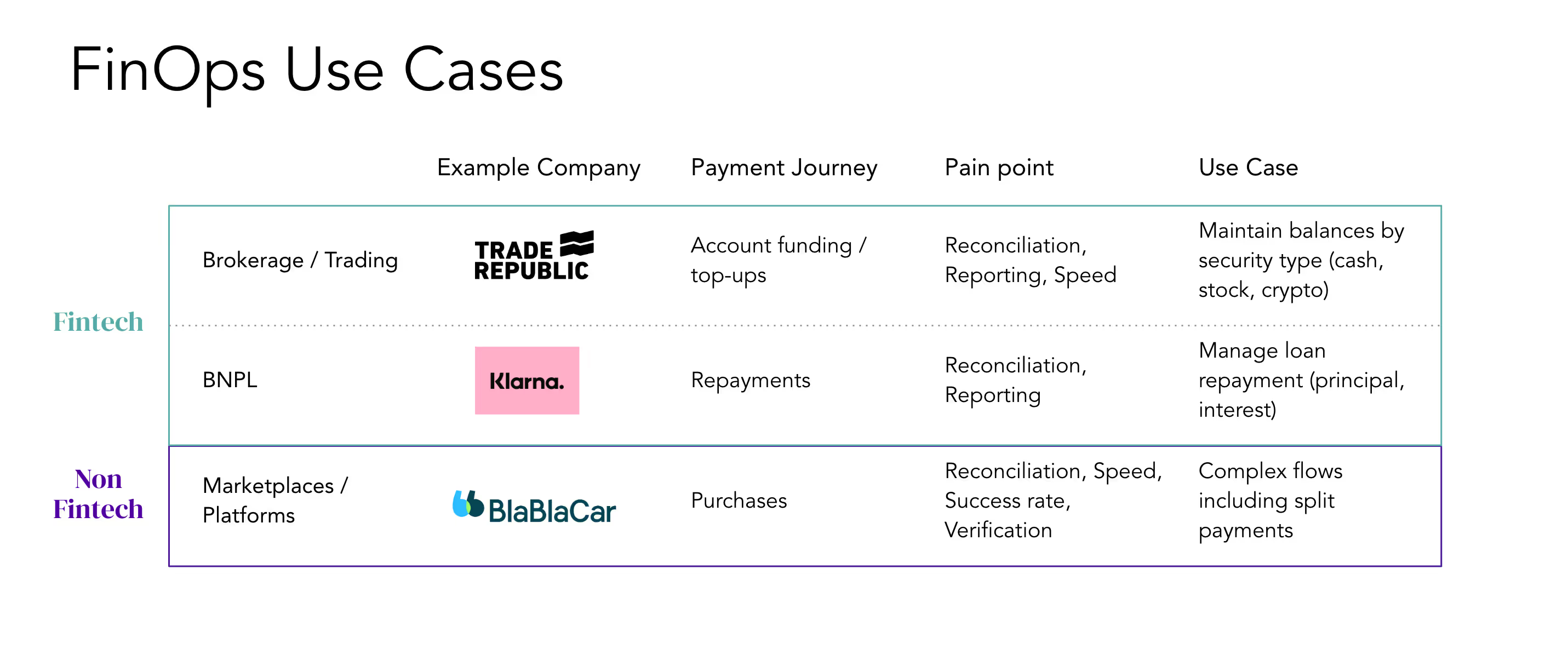

To keep up with increasingly complex payments stacks, financial operations teams have been growing in size. Reconciliation and transaction accounting across various pay-in and pay-out methods, as well as tracking payment flows and company performance in real-time today have become complex and expensive operational burdens. Multiple uploads of CSV files, manual data entry, and reconciliation is the current norm, but a new generation of FinOps companies are emerging to help companies streamline finance operations and facilitate the movement and reconciliation of payments.

The likes of Modern Treasury in the US have developed API-first platforms that facilitate money movements and reconciliation of ACH and bank payments on the payout side. We believe, however, that there are regional champions to be built as payment methods, banking rails, and regulatory landscape can vary geographically. We've been excited by the early companies that are working in this area, and are looking forward to seeing leading European solutions emerge.

Open Banking will evolve into Open Finance and then eventually Open Data

The explosion of Open Banking in Europe was largely driven by PSD2 and the CMA order that created standards around bank APIs in Europe and mandated that banks provide API access to regulated third parties (or TPPs). This led to a proliferation of Open Banking aggregators that focused on developing and maintaining connections to banks across Europe.

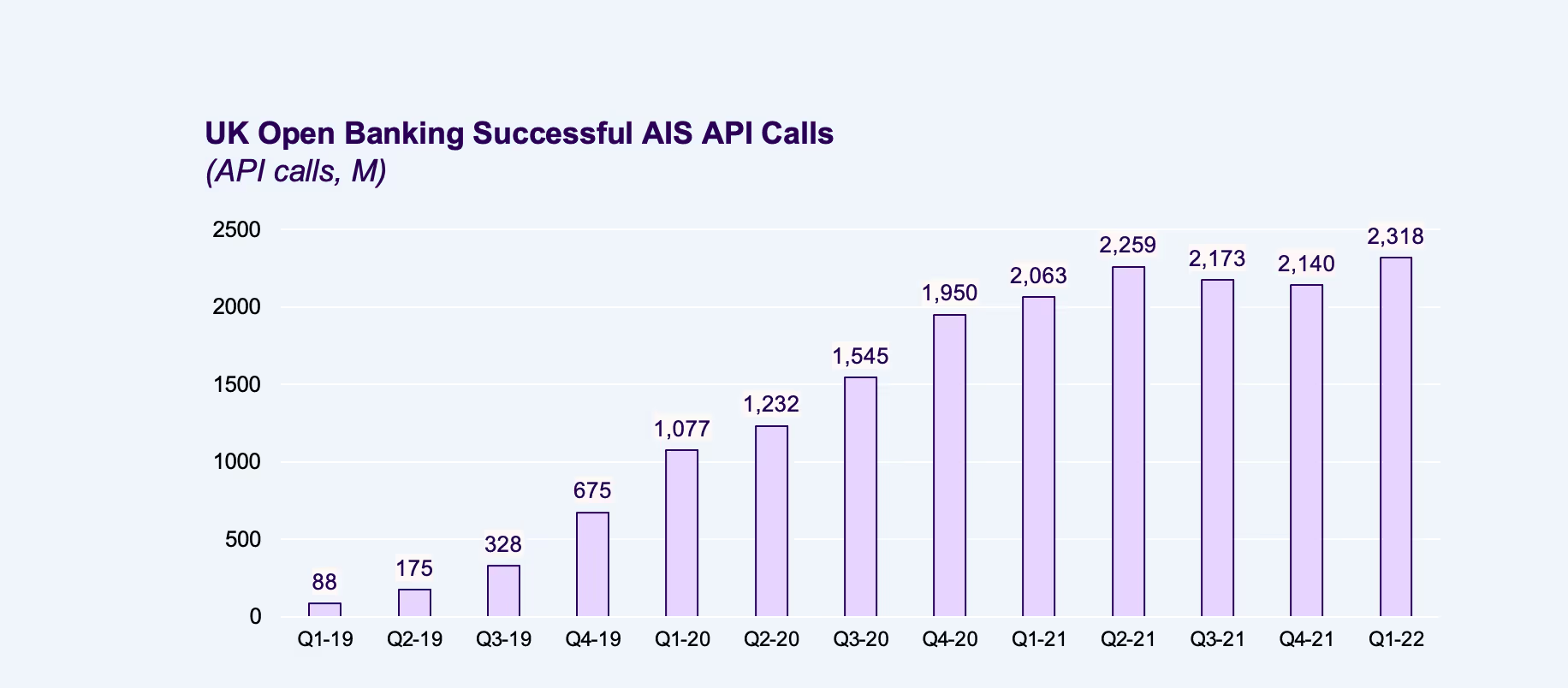

However, despite today’s market diversity in Open Banking providers, there’s little choice in the types of data they have access to (largely payment-enabled bank account data). While critical to an array of use cases — demonstrated by the growth of Account Information Calls in the UK alone — bank data does not represent the full universe of financial data that fintechs and non-fintechs could, theoretically, use.

We anticipate the proliferation of Open Finance providers who focus on non-banking data – such as payroll, insurance, loans, pension, investments, mortgages, savings, and tax data. While held back in the past due to the limitations of screen scraping and reverse engineering to access these data sets, we believe that — given the success of Open Banking — governing bodies will accelerate open access to these new data sources.

This will result in the creation of new Open Finance players. As this trend accelerates, we anticipate eventually the creation of Open Data platforms where fintechs and others can access consumer or business-permissioned data that expands beyond financial data into areas such as utility, automobile, smartphone, and smart home/IoT data. We’re just at the start of a journey that will take us to a world where the data you create and own as an individual or business will be yours to share and use to unlock better products and services driven by emerging Open Data platforms.

—–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

The European fintech Infrastructure ecosystem has created the bedrock for the proliferation of multiple unicorns and decacorns. We’re looking forward to meeting and partnering with bold and ambitious founders who are creating the next generation of companies in this space.

If you’re building the next category-defining company in the fintech infrastructure space, we’d love to hear from you at rkotite@accel.com.

Great companies aren't built alone.

Subscribe for tools, learnings, and updates from the Accel community.